The Wednesday Roundup: April 3, 2024

The Dow Jones Industrial Average fell nearly 500 points as investors grapple with persistent inflation worries and a noticeable rise in Treasury yields, signaling potential challenges ahead for equities.

The biggest movers over the last week on price and volume (Mid Cap S&P 400 and Small Cap S&P 600)

Price and volume moves last week for every stock and sector (Mid Cap S&P 400 and Small Cap S&P 600)

Last week vs. history (Mid Cap S&P 400 and Small Cap S&P 600)

Market New Summary

Stocks Retreat Amid Rising Treasury Yields and Inflation Concerns

- Stock Market Pullback: The Dow Jones Industrial Average fell nearly 500 points as investors grapple with persistent inflation worries and a noticeable rise in Treasury yields, signaling potential challenges ahead for equities.

- Treasury Yield Surge: The upward trajectory of Treasury yields continues, with the 10-year note flirting with the 5% level. This climb is a reflection of the market's ongoing concerns about inflation and the economic outlook.

- Federal Reserve's Stance: San Francisco Fed President Mary Daly indicated that there is no immediate need for the Fed to lower interest rates, suggesting a cautious approach to monetary policy amid current economic conditions.

- Oil Prices' Impact: Analysts at FHN Financial attribute the higher Treasury yields in part to the recent jump in oil prices, with crude hovering around $85 a barrel, adding to inflationary pressures.

- Tech Sector Movements: Shares of GSI Technology soared following the release of new products, while Tesla's stock faced a slump after the company's delivery numbers fell short of expectations.

- Railroad Sector Disruption: Norfolk Southern appealed to shareholders to reject an activist investor's bid amid operational challenges, including the impact of the Baltimore bridge collapse on rail operations.

- Healthcare Stocks Under Pressure: The Centers for Medicare & Medicaid Services' (CMS) proposed Medicare Advantage rates have negatively impacted shares of healthcare giants like Humana and UnitedHealth.

- Retirement Savings Concerns: With the 'magic number' for retirement savings in America reportedly surging to $1.46 million, individuals are increasingly concerned about their financial readiness for retirement.

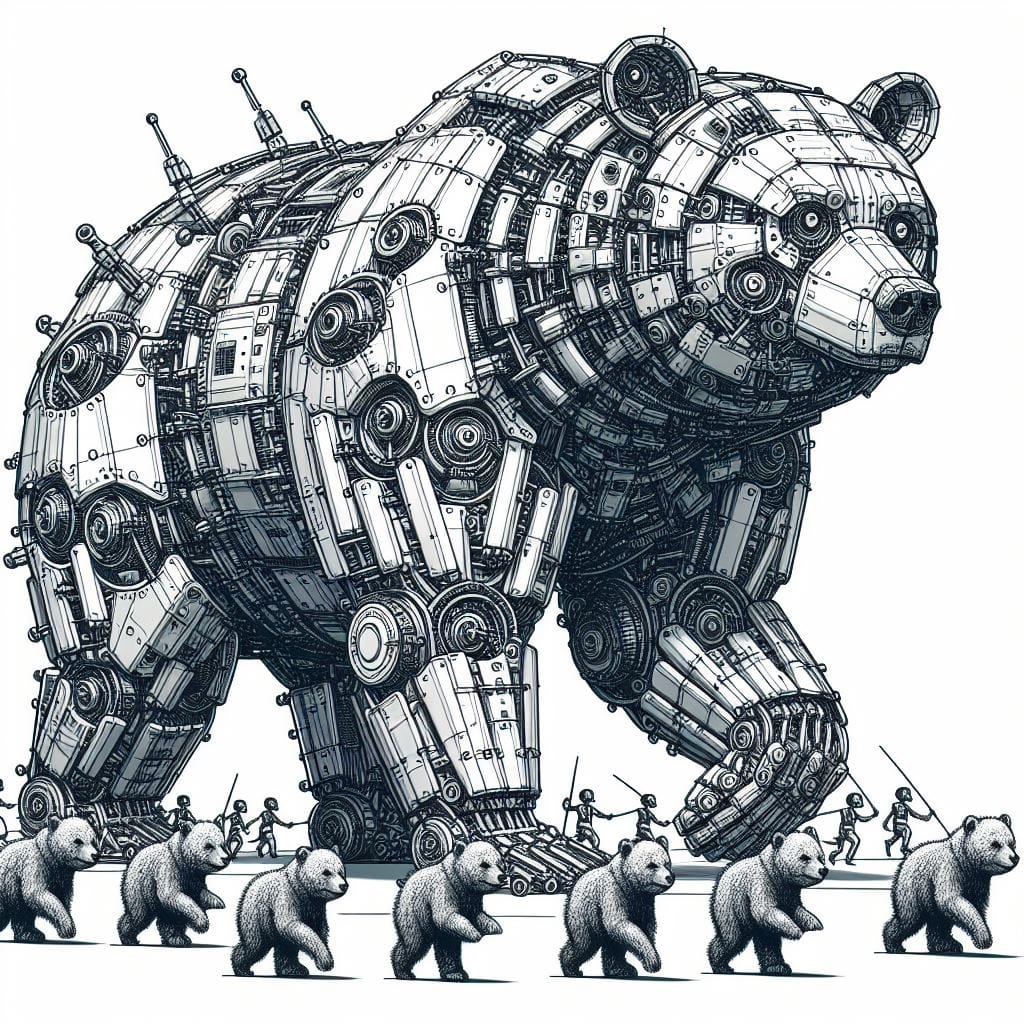

- AI and Tech Innovations: The race to integrate artificial intelligence into personal computing heats up, with Intel, AMD, and Qualcomm vying for dominance, although challenges remain in outpacing the competition.

- Real Estate Market Trends: The real estate sector shows signs of cooling in several hot markets, with price reductions observed in key cities, potentially signaling a shift in the housing market dynamics.

Investors remain vigilant as they navigate through a complex landscape of economic signals, with a keen eye on the Federal Reserve's next moves and the broader implications of inflation and interest rate trends on market stability.

AI stock picks for the week (Mid Cap S&P 400 and Small Cap S&P 600)

Subscribe for AI stock picks (it's free!)