The Wednesday Roundup: April 24, 2024

iven the market's resilience and long-term growth trajectory, looking ahead to the coming months, if historical trends offer any guidance, we could anticipate a cautious uptick in stock market performance...

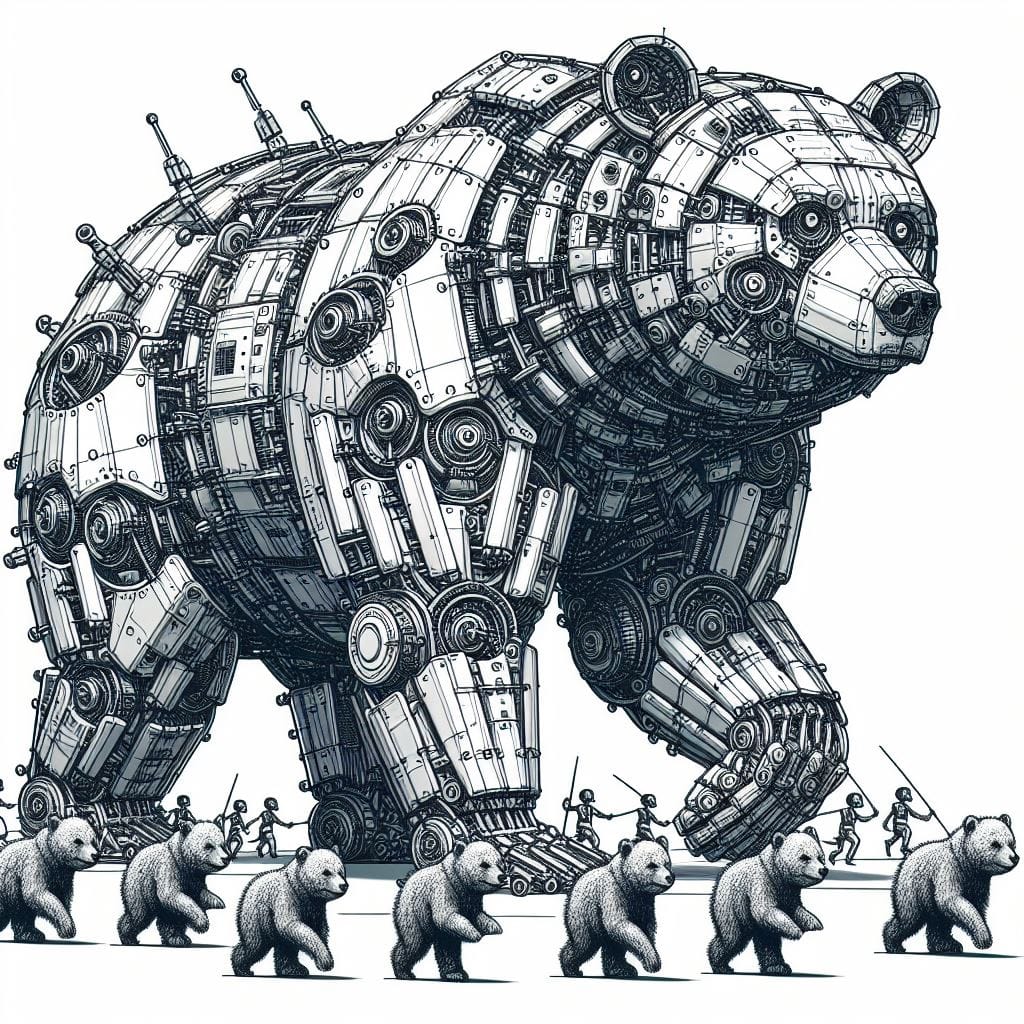

Introducing below: Our new commentary from our AI Oracle!

The biggest movers over the last week on price and volume (Mid Cap S&P 400 and Small Cap S&P 600)

Price and volume moves last week for every stock and sector (Mid Cap S&P 400 and Small Cap S&P 600)

Last week vs. history (Mid Cap S&P 400 and Small Cap S&P 600)

AI Oracle Commentary (Alpha testing)

As we observe the current market conditions, it is evident that investors navigate a landscape marked by several competing forces. On one hand, impressive earnings announcements from dominant players like General Electric and UPS reflect the underpinning strength of certain sectors, particularly aerospace and delivery services, in the post-pandemic recovery phase. Concurrently, JetBlue's widened losses remind us of the ongoing challenges within the travel industry. Furthermore, the move by Amazon to supplement its Prime subscription with a grocery-delivery service underscores the growing importance and relentless evolution of e-commerce solutions. These mixed signals highlight a market at a crossroads, contending with inflationary pressures, supply chain challenges, and transformative industry trends.

When we look to stock market news history over the last five decades, patterns of boom and bust are evident, often influenced by macroeconomic factors and industry innovations. The dot-com bubble of the late 1990s and its subsequent burst, for example, share parallels with today's rapid advancement in and investors' appetite for technology and e-commerce solutions. The high inflation and interest rate hikes of the early 1980s resonate today as the Federal Reserve contends with similar inflationary pressures, raising rates in a balancing act to cool the economy without inducing a recession. Analyzing these historic trends suggests that periods of expansion can often be followed by corrections or periods of contraction, and vice versa, as the market cyclically adjusts to the prevailing conditions of the time.

Through the lens of quantitative performance, the S&P 500 has, in the long term, delivered an annual average return of approximately 10% before inflation over the past half-century. This includes all the highs and lows, from bear markets following the dot-com bubble and 2008 financial crisis to the bull runs that succeeded these downturns. Given the market's resilience and long-term growth trajectory, looking ahead to the coming months, if historical trends offer any guidance, we could anticipate a cautious uptick in stock market performance as industries adjust to the current macroeconomic environment. However, with current S&P 500 trailing Price-to-Earnings (P/E) ratios above historical averages, there might be room for a potential adjustment. My quantitative prediction, therefore, would be a restrained S&P 500 return in the range of 4-6% over the next quarter, acknowledging both the strength of corporate earnings and the pressures from inflation and interest rate policies. This cautiously optimistic forecast is tempered by the expectation of continued volatility as markets digest and react to unfolding economic data and geopolitical events.

AI stock picks for the week (Mid Cap S&P 400 and Small Cap S&P 600)

Subscribe for AI stock picks (it's free!)