The Walt Disney Company (DIS), Large Cap AI Study of the Week

August 13, 2024

Weekly AI Pick from the S&P 500

Company Overview

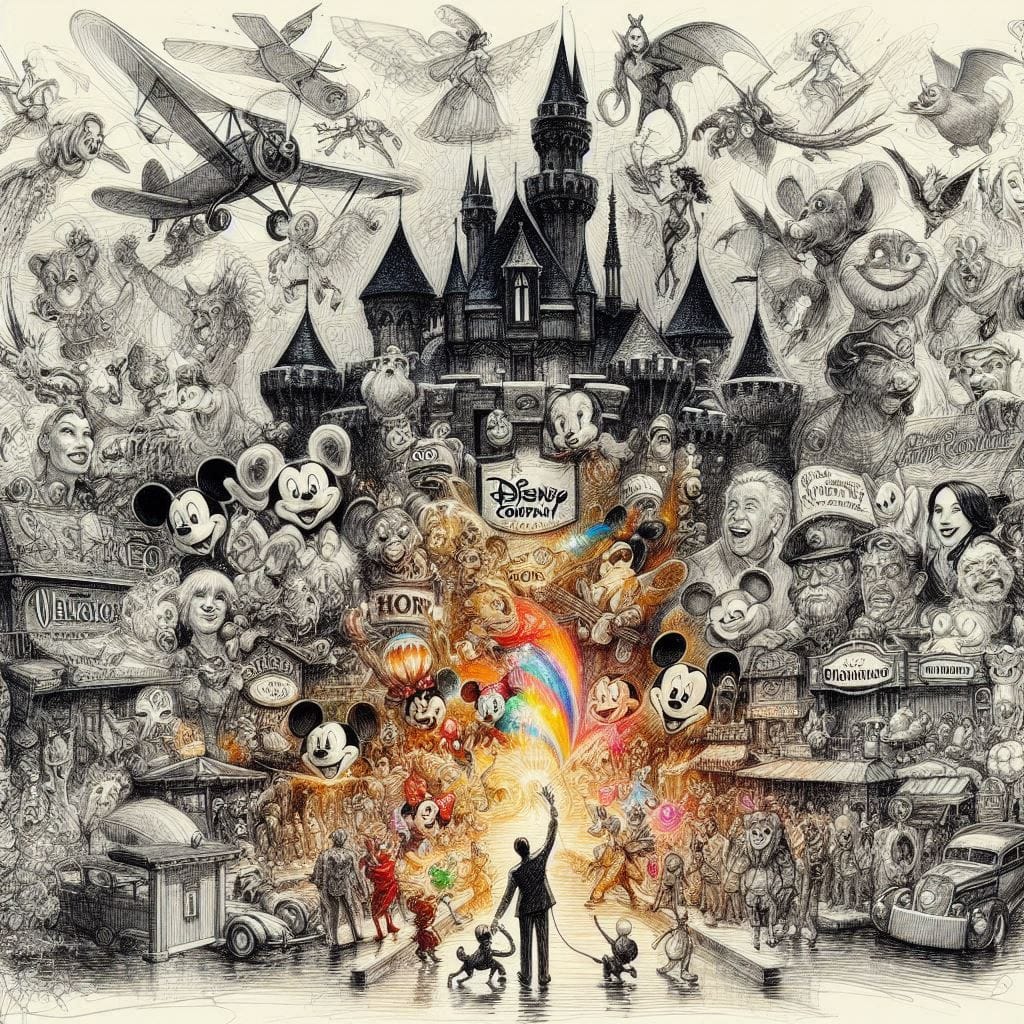

The Walt Disney Company operates in three major segments: Entertainment, Sports, and Experiences. The company places a strong emphasis on human capital management, focusing on attracting, developing, and retaining high-quality talent through diverse programs and initiatives, including health and wellness benefits, diversity and inclusion, and talent development. With a global workforce of around 225,000 employees, predominantly full-time and significantly unionized, Disney’s Entertainment segment is a substantial revenue driver. This segment includes linear networks like ABC and Disney channels, direct-to-consumer (DTC) services such as Disney+ and Hulu, and international television channels. New areas poised to drive future revenue growth include the expansion of DTC streaming platforms and sustainability initiatives aimed at mitigating environmental impacts.

Disney’s revenue streams are diverse, encompassing affiliate fees from multi-channel video programming distributors for delivering content, subscription fees for streaming services, and advertising sales. The company also generates revenue from licensing content for TV and video-on-demand (VOD), theatrical and home entertainment distributions, staging live entertainment events, and music distribution. Notable equity investments include a 50% stake in A+E Networks, which offers a range of channels that distribute programming via licensing agreements. New areas of business fueling revenue and profit growth involve expanding the DTC service, which offers general entertainment programming, and international markets, with nearly 285 general entertainment and family channels across approximately 190 countries. The Sports segment, primarily driven by its 80% ownership of ESPN, includes multiple ESPN-branded domestic and international channels and covers a wide range of sporting events, with significant revenue derived from affiliate fees, advertising, and subscription fees. New ventures such as the agreement with PENN Entertainment, under which Disney provides promotional services and licenses the ESPN BET trademark, signify potential growth areas for revenue and profit.

In the Experiences segment, significant revenue sources include theme park admissions, resort stays, vacation sales, park merchandise, and licensing its intellectual property for consumer goods. The experiences sector also features robust international operations, such as Disneyland Paris, Hong Kong Disneyland, and Shanghai Disney Resort, alongside licensing agreements for Tokyo Disney Resort. Walt Disney World Resort and Disneyland Resort are pivotal assets, offering attractions, hotels, retail, and recreation, and play a central role in Disney's advertising strategy. As of September 2023, Disney+ Core has approximately 113 million paid subscribers, Disney+ Hotstar has about 38 million, and Hulu has around 49 million, with new revenue-driving areas including an ad-supported Disney+ service launched in the U.S. and select international markets. The company's content production spans various well-known studios and includes a considerable library accumulated over nearly a century, with plans to produce or commission around 225 new episodic and film titles in fiscal 2024, contingent upon the resumption of productions following industry work stoppages.

By the Numbers

Fiscal 2023 Annual 10-K Report Summary:

- Total revenues: $88.9 billion (7% increase)

- Net income attributable to Disney: $2.4 billion (25% decrease)

- Costs of services and products: Rose by 9% and 11%, respectively

- Selling, general, and administrative expenses: Decreased by 6%

- Restructuring and impairment charges: $3.892 billion

- Equity in the income of investees: $782 million ($34 million decrease)

- Effective income tax rate: 28.9% (decreased from 32.8% in 2022)

- Net income from continuing operations attributable to noncontrolling interests: $1.036 billion (significant increase from $360 million)

- TFCF and Hulu acquisition amortization: $1.998 billion

- Entertainment segment revenue: $40.6 billion (3% increase)

- Entertainment segment operating income: $1.4 billion (32% decrease)

- Direct-to-Consumer revenues: Increased by 11%

- Linear Networks revenues: Decreased by 9%

- Direct-to-Consumer operating loss: Improved by $928 million to $2.496 billion

- Content Sales/Licensing and Other operating results: Loss of $179 million (from prior income of $352 million)

- Sports segment revenues: Slight decline by 1%

Most Recent Quarterly 10-Q Report Summary (Q3 Fiscal 2024):

- Total revenues: $23.2 billion (4% increase)

- Net income attributable to Disney: $2.6 billion (from a loss of $460 million)

- Diluted EPS: $1.43 (up from a loss of $0.25 per share)

- Nine months ended June 29, 2024, revenues: $68.8 billion (2% increase)

- Nine months ended June 29, 2024, EPS: $2.46 (from $1.14)

- Depreciation and amortization: $3.7 billion (6% decrease)

- Restructuring and impairment charges: $2,052 million

- Interest expense net: $899 million (3% decrease)

- Effective income tax rate: 21.3%

- Net income attributable to noncontrolling interests: Increased by 15%

- Entertainment segment operating income for the quarter: $1,201 million

- Sports operating income for the quarter: $802 million (6% decrease)

- Experiences operating income for the quarter: $2,222 million (3% decrease)

- Entertainment segment total revenue for the quarter: $10,580 million (4% increase)

- Income before income taxes for the quarter: $3,093 million (from a loss of $134 million)

- Domestic Disney+ average monthly revenue per paid subscriber: Decreased to $7.74

- International Disney+ (excluding Hotstar) average monthly revenue per paid subscriber: Increased to $6.78

- Disney+ Hotstar average monthly revenue per paid subscriber: Increased to $1.05

- Hulu SVOD Only average monthly revenue per paid subscriber: Increased to $12.73

- Hulu Live TV + SVOD average monthly revenue per paid subscriber: Increased to $96.11

- DTC segment operating loss for the quarter: Improved to $19 million (from $505 million)

- Content Sales/Licensing and Other segment revenue for the quarter: Decreased to $2,112 million

- Content Sales/Licensing and Other segment profit for the quarter: $254 million (from a loss of $112 million)

- ESPN+ average monthly revenue per paid subscriber: Increased to $6.23 (14% increase)

- Theme parks and experiences segment revenue for the quarter: $8,386 million (2% increase)

- Theme parks and experiences segment operating income for the quarter: $2,222 million (decrease from $2,297 million)