Lamb Weston Holdings, Inc. (LW), Large Cap AI Study of the Week

July 30, 2024

Weekly AI Pick from the S&P 500

Company Overview

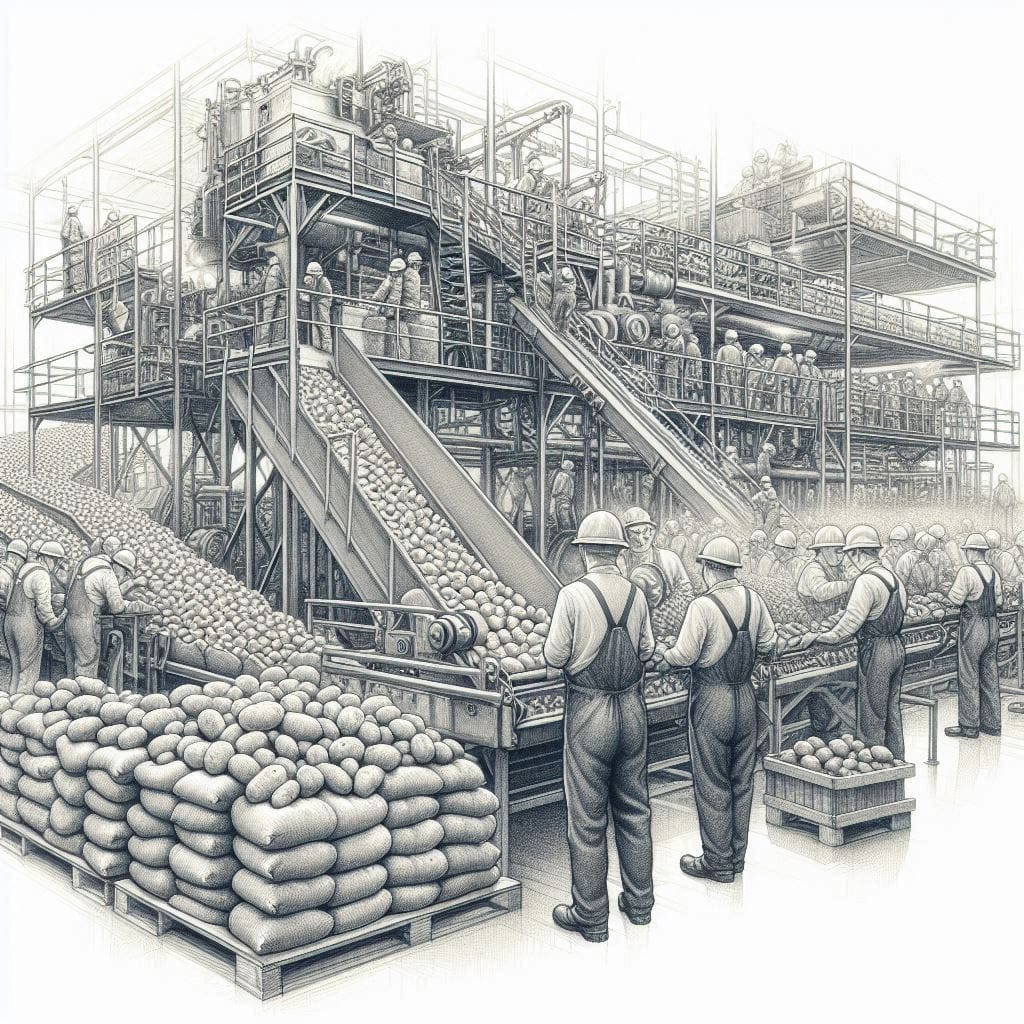

Lamb Weston Holdings, Inc. is a prominent global producer, distributor, and marketer of value-added frozen potato products, such as French fries, operating in over 100 countries. Headquartered in Idaho, the company operates primarily in two segments: North America and International. In North America, Lamb Weston’s products are sold to restaurants, foodservice distributors, non-commercial channels, and retailers under brands like Lamb Weston, Grown in Idaho, and Alexia. Internationally, the company holds significant joint ventures, including a 90% interest in an Argentine venture and full ownership of a European venture. Lamb Weston focuses on research and development to drive future revenue and profit growth through new product creation, process innovations for sustainability, and joint menu planning with customers.

The company operates in a competitive industry, contending with significant players such as Agristo NV, McCain Foods Limited, and The Kraft Heinz Company. Seasonality affects inventory levels and financial performance, with the highest segment adjusted EBITDA typically seen in fiscal Q3. Lamb Weston emphasizes employee well-being, fostering a zero-incident safety culture and offering comprehensive compensation and benefits packages. The company also prioritizes diversity, equity, and inclusion, along with recruitment, training, and development initiatives to maintain a robust talent pipeline. Lamb Weston’s executive leadership, including CEO Thomas P. Werner and CFO Bernadette M. Madarieta, ensures adherence to codes of conduct and ethics, with corporate governance principles and committee charters available online. The company complies with extensive food safety, labeling, environmental, health, and safety regulations, often requiring substantial investments. Lamb Weston provides various reports and important information on its website, emphasizing that such online information isn't part of its SEC filings unless stated otherwise.

By the Numbers

Net sales FY 2024: $6,467.6 million (21% increase from previous year)

- Net sales growth excluding acquisitions: <1%

- Volume decline: 10%

- North America segment net sales: $4,363.2 million (3% increase)

- International segment net sales: $2,104.4 million (91% increase; 9% decline excluding acquisitions)

- Net income FY 2024: $725.5 million (28% decrease from previous year)

- Adjusted EBITDA FY 2024: $1,416.7 million (13% increase)

- Gross profit FY 2024: $1,766.7 million (23% increase)

- ERP transition negative impact: $95 million

- Product withdrawal pre-tax loss: $40 million

- SG&A expenses FY 2024: $701.4 million (28% increase)

- Interest expenses FY 2024: $135.8 million (24% increase)

- Operational cash flow FY 2024: $798.2 million (significant improvement)

- Total contractual obligations: $6,101.7 million

- Accrued liabilities for trade promotions and sales incentives: $90.0 million

- Adjusted EBITDA FY 2023: $1,249.4 million

- Net income FY 2023: $1,008.9 million

Q3 FY 2024 Key Numbers:

- Net sales Q3 FY 2024: $1,458.3 million (16% increase year-over-year)

- North America segment sales Q3 FY 2024: 12% decline

- Adjusted EBITDA North America Q3 FY 2024: 14% decrease

- Adjusted EBITDA International Q3 FY 2024: 88% increase

- Net cash from operating activities (first three quarters): $481.5 million ($146.4 million increase from prior year)

- Shareholder returns (dividends and share repurchases): $272.0 million

- Cash and cash equivalents Q3 FY 2024: $62.3 million

- Available liquidity under credit facilities: $908.8 million

- Gross profit Q3 FY 2024: $403.7 million (1% increase)

- Adjusted gross profit Q3 FY 2024: $427.0 million ($24.1 million increase year-over-year)

- SG&A expenses Q3 FY 2024: $179.8 million ($48.3 million increase)

- Net income Q3 FY 2024: $146.1 million ($29.0 million decrease)

- Adjusted EBITDA Q3 FY 2024: $343.6 million ($8.6 million decrease)

- International segment net sales increase: $1,038.9 million (183% increase)

- Gross profit increase (first three quarters): $326.1 million (31% increase)

- Adjusted SG&A increase (first three quarters): $117.9 million

- Net income growth (first three quarters): $85.7 million

- Cash provided by operating activities (first three quarters): $481.5 million ($146.4 million increase)

- Investing activities outflow (first three quarters): $824.8 million

- Financing activities yield (first three quarters): $100.1 million

- Adjusted EBITDA (first three quarters): $1,133.4 million (up from $915.7 million)

- Cash and cash equivalents decrease: to $62.3 million from $675.0 million