November 4, 2023

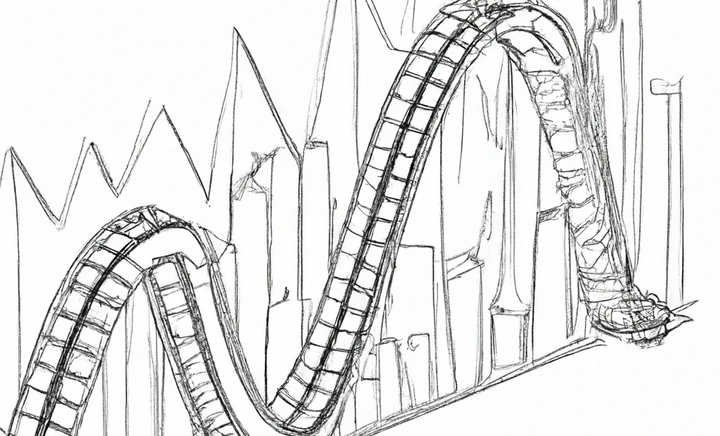

As we embarked on the fourth quarter of the year, the stock market was a hive of activity. However, the direction of the market seems to be highly influenced by major themes that have surfaced over the past few weeks. This article will address some of these themes and attempt to decipher how they might impact the stock market trajectory.

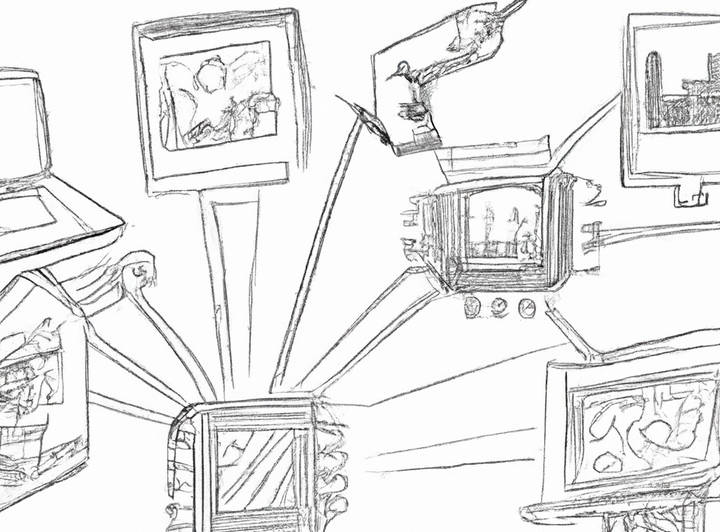

A key influence on the market has been the ongoing discussion around artificial intelligence (AI) technology. With Musk's xAI gearing up to launch the first AI model to a select group, there's a palpable excitement in the tech sector. As artificial intelligence continues to permeate various industries, investors should keep a close eye on companies pioneering AI technology as they could potentially deliver significant returns. But the regulatory landscape for AI is still nascent, posing a degree of uncertainty that could impact market direction.

Apple’s warning of a dull holiday quarter sent a shiver through the tech industry, causing its stock to tick lower. This warning comes amidst a global chip shortage, which has consequently affected the production of various tech products. Despite the easing tensions between the U.S and China's chipmaker Micron, the ongoing chip shortage is likely to cause price inflation across multiple sectors, which could lead to market volatility.

Cybersecurity remains a hot topic, with India's Infosys revealing a security event in its U.S. unit. The ever-present threat of cyber-attacks has led to heightened demand for cybersecurity solutions. However, a drop in Fortinet and rival stocks due to concerns around cybersecurity spending suggests a degree of market apprehension. This could create an interesting dynamic in the market, with potential investment opportunities in the cybersecurity sector.

Cryptocurrencies also continue to make headlines, with the U.S. Supreme Court taking up a Coinbase arbitration dispute. As authorities' scrutiny on cryptocurrency bosses intensifies, market sentiments around crypto stocks could swing in either direction. The high volatility and regulatory uncertainty of the crypto market continue to pose a considerable risk for investors.

The spotlight on streaming platforms is also impacting the market, with Paramount narrowing its streaming loss forecast as its investments peak. The growth of the streaming sector and the fierce competition for market share could drive innovation and growth in the entertainment industry, presenting new investment opportunities.

In the backdrop of these themes, the Federal Reserve's stance on interest rates remains a significant factor in the market direction. The prospect of rising interest rates can often lead to increased market volatility, as investors adjust their portfolios to account for higher borrowing costs. The tension surrounding the Federal Reserve's decisions could lead to short-term uncertainty in the market.

The shift towards sustainable and clean energy is another theme that could affect market direction. As more companies commit to reducing their carbon footprint, those providing green solutions are likely to benefit. However, the costs associated with this transition could impact profitability in the short term.

Lastly, geopolitical tensions, particularly between the U.S. and China, continue to weigh on the market. The trade war and its subsequent effect on global supply chains have added another layer of complexity to the market.

In conclusion, while these themes provide a broad range of potential investment opportunities, they also underscore the uncertainties and risks inherent in the stock market. Investors should always consider their risk tolerance and investment horizons when making decisions in this ever-evolving landscape.

Comments ()